"Rusty Vandura - www.tinyurl.com/keepoppo" (rustyvandura)

"Rusty Vandura - www.tinyurl.com/keepoppo" (rustyvandura)

02/18/2019 at 14:12 • Filed to: None

1

1

39

39

"Rusty Vandura - www.tinyurl.com/keepoppo" (rustyvandura)

"Rusty Vandura - www.tinyurl.com/keepoppo" (rustyvandura)

02/18/2019 at 14:12 • Filed to: None |  1 1

|  39 39 |

Not due to inadequate withholding, income changes or any other factors. My tax bill was $2,200 higher this year than it would have been last year, before the new tax law.

Mid Engine

> Rusty Vandura - www.tinyurl.com/keepoppo

Mid Engine

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 14:23 |

|

We received $6k back last year, per TurboTax using the standard $24k deduction we owe $12k this year. Will be meeting with a CPA to figure out how to make this reasonable. Fuck you Trump, I hope all you right leaning MAGA lovers learn a lesson from this.

VincentMalamute-Kim

> Mid Engine

VincentMalamute-Kim

> Mid Engine

02/18/2019 at 14:32 |

|

You have only yourself to blame for not being Jeff Bezos. /s

StndIbnz, Drives a MSRT8

> Rusty Vandura - www.tinyurl.com/keepoppo

StndIbnz, Drives a MSRT8

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 14:32 |

|

I’m afraid to do my taxes. I owed last year, I can only imagine what this year will bring.....

BobintheMtns

> Mid Engine

BobintheMtns

> Mid Engine

02/18/2019 at 14:32 |

|

Learn a lesson? Ha.. Next election, all the repub’s have to do make a few racist dog whistles and all the maga types will go running back home....

But hey, the Koch brothers and the other billionaires

thank you for picking up the slack for their tax break...

lone_liberal

> Rusty Vandura - www.tinyurl.com/keepoppo

lone_liberal

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 14:36 |

|

For various reasons that include living in a state that doesn’t have an income tax and having a spouse that knew to compensate for the changes just not how much, we’re one of the precious few to get a larger than expected refund but we still paid more this year than last year. Fuckers.

BigBlock440

> Mid Engine

BigBlock440

> Mid Engine

02/18/2019 at 14:39 |

|

I did, I paid $1k less than last year, on top of getting a raise. That’s a win.

Rusty Vandura - www.tinyurl.com/keepoppo

> Mid Engine

Rusty Vandura - www.tinyurl.com/keepoppo

> Mid Engine

02/18/2019 at 14:40 |

|

From what my tax man explained this morning, and to the extent that I understood it, you do well under this deal if you have young children and you’re on the lower end of the earning spectrum, which would cover many of what we are told are members of Trump’s base.

BigBlock440

> Rusty Vandura - www.tinyurl.com/keepoppo

BigBlock440

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 14:42 |

|

I assume due to not being able to deduct the exorbitant state taxes this year? That seemed to be the biggest thing people were complaining about a year ago.

Rusty Vandura - www.tinyurl.com/keepoppo

> lone_liberal

Rusty Vandura - www.tinyurl.com/keepoppo

> lone_liberal

02/18/2019 at 14:42 |

|

I assume that the people who get a break this year will be people likely to vote for Trump, or the ten richest men on the planet and their

courtiers

. I’m tired of winning, just like President Trump promised I’d be.

Rusty Vandura - www.tinyurl.com/keepoppo

> BigBlock440

Rusty Vandura - www.tinyurl.com/keepoppo

> BigBlock440

02/18/2019 at 14:44 |

|

No, due to a change in exemptions and credits for children. I paid very little state income tax this year, so very little effect.

Tekamul

> Rusty Vandura - www.tinyurl.com/keepoppo

Tekamul

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 14:51 |

|

Are you tired of all the winning yet?

Rusty Vandura - www.tinyurl.com/keepoppo

> Tekamul

Rusty Vandura - www.tinyurl.com/keepoppo

> Tekamul

02/18/2019 at 14:56 |

|

Well, I’m tired of all the

whining

. Just sick and tired.

Manwich - now Keto-Friendly

> Rusty Vandura - www.tinyurl.com/keepoppo

Manwich - now Keto-Friendly

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 14:57 |

|

So what you’re saying is Crooked Trump is crooked for doing a bait-and-switch?

KingT- 60% of the time, it works every time

> Rusty Vandura - www.tinyurl.com/keepoppo

KingT- 60% of the time, it works every time

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 15:00 |

|

But hey, those 631 Billionaires aka “Job creators” in the US are happy and that’s what matters, so shut up peasant!

Yes, I got a lower return this year. At least I didn’t owe taxes.

Manwich - now Keto-Friendly

> StndIbnz, Drives a MSRT8

Manwich - now Keto-Friendly

> StndIbnz, Drives a MSRT8

02/18/2019 at 15:04 |

|

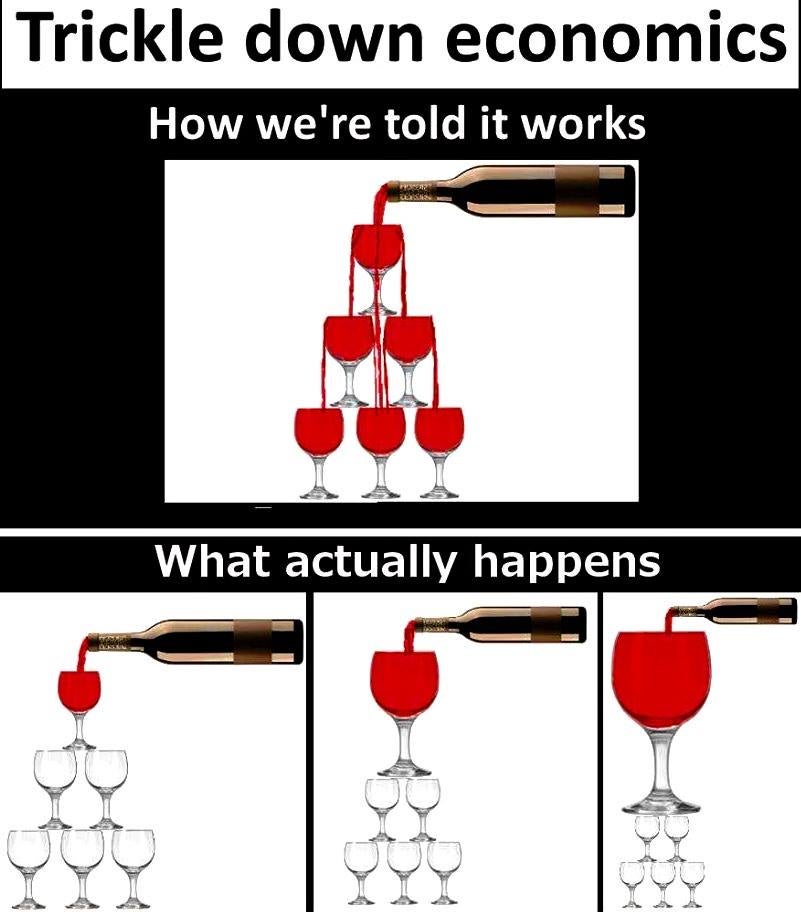

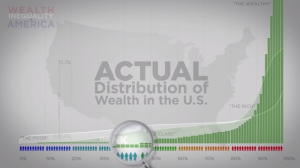

“I can only imagine what this year will bring.....”

Let me answer that for you in pictures:

Rusty Vandura - www.tinyurl.com/keepoppo

> Manwich - now Keto-Friendly

Rusty Vandura - www.tinyurl.com/keepoppo

> Manwich - now Keto-Friendly

02/18/2019 at 15:19 |

|

No, I’m saying that my tax bill would’ve been $2,200 less last year for the same numbers.

Rusty Vandura - www.tinyurl.com/keepoppo

> KingT- 60% of the time, it works every time

Rusty Vandura - www.tinyurl.com/keepoppo

> KingT- 60% of the time, it works every time

02/18/2019 at 15:20 |

|

631? It’s

that

many? I thought it would be fewer than that.

KingT- 60% of the time, it works every time

> Rusty Vandura - www.tinyurl.com/keepoppo

KingT- 60% of the time, it works every time

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 15:24 |

|

Correction: So it’s 631 for North America, 585 for US. A record of 2,208 billionaires were in the ranking for world, and the total wealth was $9.1 trillion, up 18% since 2017. Just imagine how much wealth, influence and outright power just 2200 or so people out of 7 Billion control.

https://en.wikipedia.org/wiki/List_of_countries_by_the_number_of_billionaires

LimitedTimeOnly @ opposite-lock.com

> Rusty Vandura - www.tinyurl.com/keepoppo

LimitedTimeOnly @ opposite-lock.com

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 16:23 |

|

I went back and checked. We actually paid 15% tax on our income last year, and only 14.5% this year (for 2018). But with raises, and not enough withholding, had to write a large check to the feds. Withholding has now been adjusted significantly.

Dru

> Rusty Vandura - www.tinyurl.com/keepoppo

Dru

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 16:27 |

|

That has to sting. I don’t know how all the math works out, and our incomes weren’t vastly different from the year before, but my refund was largely the same as last year, with the notable 50% increase we saw from having a child in 2018. My withholding went down, resulting in a net extra $20 every two weeks, and yeah refund would’

ve been about the same without the child tax credit.

Mercedes Streeter

> Rusty Vandura - www.tinyurl.com/keepoppo

Mercedes Streeter

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 16:31 |

|

It must be the really low end of the earning spectrum. I only make like $45k before taxes and if it weren’t for that house I technically own I would have owed the feds this year. And like you, nothing about my life has changed in the past 12 months to warrant it.

Mercedes Streeter

> Rusty Vandura - www.tinyurl.com/keepoppo

Mercedes Streeter

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 16:37 |

|

My refund this year is only $100 less than last year. My saving grace was that my mum paid significantly more in taxes in 2018 on the house she owns (that’s in my name, so they’re actually my property taxes), and thus I got to claim a rather large property tax deduction.

If it weren’t for that house (which I shouldn’t even own), I would have owed the feds. Checked just to make sure I wasn’t missing anything or doing anything wrong. I wasn’t, it’s just how the changes to the tax code and deductions/credits impact me.

StndIbnz, Drives a MSRT8

> Manwich - now Keto-Friendly

StndIbnz, Drives a MSRT8

> Manwich - now Keto-Friendly

02/18/2019 at 16:47 |

|

That’s about what I’m guessing. Wife has a job where they don’t take taxes out, but luckily last year didn’t make too much off of it. So hopefully that doesn’t screw us like it did last year. As long as I can still deduct tuition, we should be good.

Mid Engine

> StndIbnz, Drives a MSRT8

Mid Engine

> StndIbnz, Drives a MSRT8

02/18/2019 at 16:56 |

|

Big nope on deducting tuition unless you itemize

Nick Has an Exocet

> Rusty Vandura - www.tinyurl.com/keepoppo

Nick Has an Exocet

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 17:37 |

|

I’m looking forward to see how this works out for me this year. I typically have an enormous tax burden being a California resident. Last 2 years were 43% and 42%. This is, of course, while living in a ghetto with a roommate and a 2 hour/day commute. My 2019 taxes will be even more hell. Assuming my company is still around, they owe me a “bonus” equal to the amount of money I should have made when instead I got an empty promotion in 2018. That bonus will bump me an extra tax bracket and cost me at least another $10k - I may end up having to decline that bonus if I can’t shove enough into retirement. Sigh.

Rusty Vandura - www.tinyurl.com/keepoppo

> Mercedes Streeter

Rusty Vandura - www.tinyurl.com/keepoppo

> Mercedes Streeter

02/18/2019 at 18:31 |

|

I use a tax guy and he compared the monies. I have a new gig this year as well, providing private tutoring through a contractor and all of that income gets reported on a 1099, so it’s all cash and I have to pay the self-employment tax of 15.3% on top of whatever my marginal tax rate is, which was 22% this year. So that income is taxed at 37.3%.

Rusty Vandura - www.tinyurl.com/keepoppo

> Mercedes Streeter

Rusty Vandura - www.tinyurl.com/keepoppo

> Mercedes Streeter

02/18/2019 at 18:32 |

|

Sounds like you dodged a bullet.

Rusty Vandura - www.tinyurl.com/keepoppo

> Nick Has an Exocet

Rusty Vandura - www.tinyurl.com/keepoppo

> Nick Has an Exocet

02/18/2019 at 18:36 |

|

So none of the nuclear family deductions for mortgage interest or chilluns, I guess. We’ve traditionally done well in that arena. We also paid $16,600 in health insurance premiums in 2018...

We paid 1.6% of our gross income in state income tax...

Mercedes Streeter

> Rusty Vandura - www.tinyurl.com/keepoppo

Mercedes Streeter

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 18:52 |

|

I just realized I basically replied to you twice. *facepalm* lol

Wait...what? There’s a tax for being self-employed on top of whatever you’ll already have to pay in tax? Holy smokes.

Rusty Vandura - www.tinyurl.com/keepoppo

> Mercedes Streeter

Rusty Vandura - www.tinyurl.com/keepoppo

> Mercedes Streeter

02/18/2019 at 19:18 |

|

Yes. Medicare. If you are employed by someone else, the employer withholds that on your behalf. Supposedly. So gig people like Uber drivers have to pay that.

Which is an entire thing about how Uber, in particular, is not a good deal because wear and tear on the car, insurance, et cetera, atop the other things we’re talking about here.

wkiernan

> Mercedes Streeter

wkiernan

> Mercedes Streeter

02/18/2019 at 20:01 |

|

No, w hat tha t 15.3% is, is Social Security and Medicare. Wage earning types like me also are taxed at nearly 15.3% for Social Security and Medicare, but it’s carefully hidden and most wage earners are unaware of it .

If you have a regular job, and the income shown on your W-2 form is less than $128,400 (this year

that is -

the cut-off changes from year to year) then the Federal government extracts 6.2% of your W-2 income for Social Security. Look at your last paycheck stub and you’ll see it listed as “FICA,” and it will be exactly 6.2% of your gross income. In addition, you’ll see a line item for Medicare, which will work out to 1.45% of the gross, for a total of 7.65% being deducted in all.

However, the income shown on your W-2 form is not what your employer is paying for your services. If they pay you, say a nice even $100,000 per year (that’s a lot more money than most wage-earners make but it makes the arithmetic easy) as shown on your W-2, they must also pay a “ hidden” matching 6.2% which is not shown on your W-2 form for your Social Security/FICA tax, and they also have to pay a “ hidden” matching 1.45% for Medicare . So, in fact, they are paying out $107,650 (plus other expenses such as health insurance) of which $12,400 is credited to your Social Security account and $2,900 to your Medicare account ; this means an actual FICA +Medicare tax rate of 15,300 /107,650 or 14.21 %.

But FICA tax is only levied against the first $128,400 of your income. So imagine you have a W-2 income of $200,000. Y ou’d only see $7,960.80 - 6.2% of $128,400 - deducted as “FICA” and your employer would only pay a “ hidden” matching $7,960.80. Medicare is not capped, s o you’d see $2,900 - 1.45% of $200,000 - deducted for Medicare, and again your employer would pay a “hidden” matching $2,900 - total for FICA+Medicare, $21,721.60 . So your employer pays $200,000, plus $7,960.80 for matching FICA contribution, plus $2,900 for matching Medicare contribution, for a total outlay of $210,860.80. Thus the actual FICA+Medicare tax rate, relative to your employer’s point of view, would be 10.30% - almost a 4% lower effective FICA+ Medicare tax rate than a minimum wage worker . If you have a W-2 income of $1,000,000 per year, your FICA contribution on your paycheck would be 6.2% on the first $128,400 and zero percent on the rest ($7,960.80); plus your employer’s “hidden” matching FICA tax of 6.2% on the first $128,400 (another $7,960.80); plus Medicare tax of 1.45% of the whole $1,000,000 ($14,500), plus your employer’s “hidden” matching 1.45% Medicare tax (another $14,500). Your employer’s cost of paying you would then be $1,022,460.80, of which $44,921.60 would go to FICA and Medicare, for an effective tax rate of 4.39% - almost a 10% lower rate than a minimum wage worker pays!

Confused yet?

Now

if you’re self-employed, the arithmetic

is much

simpler. Y

ou pay the 6.2% individual FICA tax, plus the 6.2% “hidden” FICA tax that ordinary employees are mostly unaware of, plus the individual 1.45% Medicare tax, plus the “hidden” 1.45% that employers pay for ordinary wage-earners, so the self-employed have 15.3% taken off the top. Unless of course

you

have an

income

greater than the FICA cap of $128,400, for income above that you only pay 2.9% Medicare tax.

There’s been a lot of talk about Alexandri

a Ocasio-Cortes’s idea of raising the top marginal rate for above ten

million

dollar incomes

to 70%. But realistic

people should keep in mind that the

rich guys bringing in greater than $10-million per year

almost never pay the top marginal rate on their income

, because their rem

un

eration

is invariabl

y structured in terms of stock options and the like, and

their income is

taxed as capital gains, where the top marginal rate is only 20%. The FICA tax rate on capital gains is

zero

.

They do get to pay a Medicare surtax on 3.8% on capital gains, however.

Mercedes Streeter

> wkiernan

Mercedes Streeter

> wkiernan

02/18/2019 at 20:45 |

|

This has been one of the most Oppo things I’ve read! Thanks so much! I was aware of the whole FICA thing with W-2 earners like myself, but I wasn’t aware of the hidden costs.

I'm also definitely aware of the nuances about AOC's proposed tax rates. Madame DeLorean has been doing a lot of research on taxes herself as she's now making the kind of money where one would want to take advantage of the tax code.

gmporschenut also a fan of hondas

> KingT- 60% of the time, it works every time

gmporschenut also a fan of hondas

> KingT- 60% of the time, it works every time

02/18/2019 at 21:06 |

|

BigBlock440

> Nick Has an Exocet

BigBlock440

> Nick Has an Exocet

02/18/2019 at 21:13 |

|

That bonus will bump me an extra tax bracket and cost me at least another $10k - I may end up having to decline that bonus if I can’t shove enough into retirement

That’s not how tax brackets work. The higher bracket will only apply to the amount you earned above the upper limit of the previous bracket, the remainder will still be taxed at the rates that fall into those respective rackets. Since I don’t feel like looking them up, I’ll make up some numbers. Say you’re making 95k, the next bracket starts at 99k, and you get a raise to 101k, your 101k is not suddenly taxed at the 99k+ rate, only the 2k above that.

Nick Has an Exocet

> BigBlock440

Nick Has an Exocet

> BigBlock440

02/18/2019 at 21:18 |

|

Now I feel dumb. Haha, but that's really helpful info. Thanks for that. I feel a lot less terrible now.

BigBlock440

> Nick Has an Exocet

BigBlock440

> Nick Has an Exocet

02/18/2019 at 21:35 |

|

I used to think that too, but all this talk about taxes the past few years made me look up how they worked.

gmporschenut also a fan of hondas

> Rusty Vandura - www.tinyurl.com/keepoppo

gmporschenut also a fan of hondas

> Rusty Vandura - www.tinyurl.com/keepoppo

02/18/2019 at 21:59 |

|

I’m getting the lube ready.

StndIbnz, Drives a MSRT8

> Mid Engine

StndIbnz, Drives a MSRT8

> Mid Engine

02/19/2019 at 08:25 |

|

yay...........

davesaddiction @ opposite-lock.com

> LimitedTimeOnly @ opposite-lock.com

davesaddiction @ opposite-lock.com

> LimitedTimeOnly @ opposite-lock.com

02/19/2019 at 11:57 |

|

They really screwed this up politically. Made a tax cut feel like a tax increase for the vast majority of people.